In December 2023, The Florida Bar Foundation changed its name to FFLA. Posts prior to this date contain our former name.

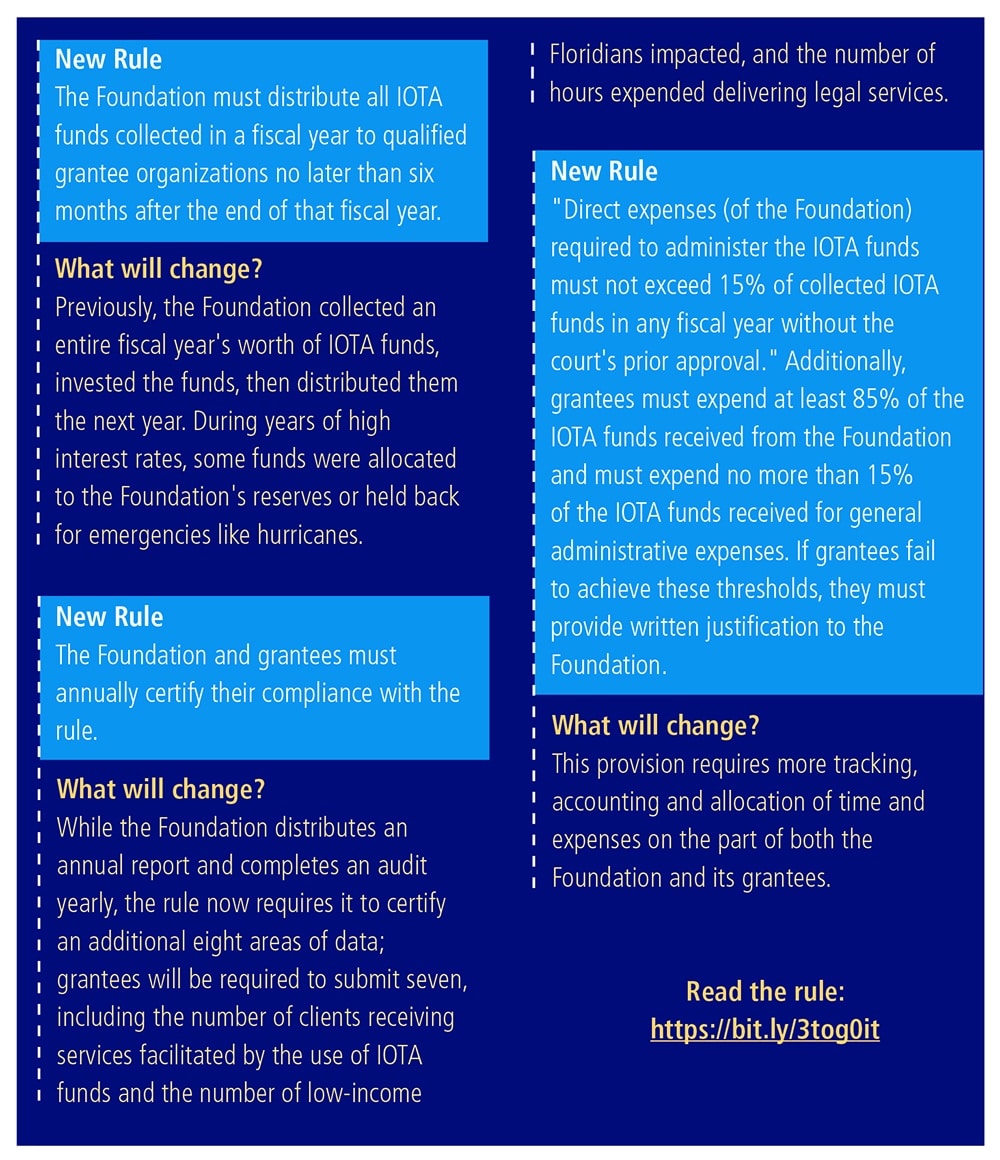

The Florida Supreme Court has amended Bar Rule 5-1.1(g), which outlines the Interest on Trust Accounts (IOTA) program. The Florida Bar Foundation has been the sole administrator of the IOTA program since 1981.

The nation’s first IOTA program, Florida’s program was the prototype for similar programs across the country and still creates millions of dollars in funding for legal aid programs each year.

Generally, under IOTA, all nominal or short-term funds belonging to clients or third persons that are placed in trusts with any Florida attorney must be deposited into one or more IOTA accounts unless the funds may earn income for the client or third person in excess of the costs incurred to secure the income. The net interest earned on these accounts is remitted to the Foundation for civil legal aid assistance.

IOTA funds historically have been allocated to three uses: legal assistance for the poor, improvements in the administration of justice, and law student assistance.

On June 18, the court issued its ruling for In re: Amendments to Rules Regulating The Florida Bar 5-1.1(g), Case No.SC20-1543. Changes to the rule provide clarifications and define new terms, address the use of IOTA distributions, and create additional reporting requirements.

“The Foundation appreciates the court’s focus on the need for more civil legal aid support and funding,” Donny MacKenzie, the Foundation’s executive director, said. “It also very much appreciates the court allowing the Foundation to remain as the IOTA funds administrator. The Foundation will endeavor to implement and carry out the revised rule as quickly, efficiently, and responsibly as possible.”

The Foundation and its board immediately began working to implement the rule changes. The board’s executive committee set meeting dates for September 9 and 23 and October 5 and 23 to finalize the new processes, procedures and changes the Foundation will make to comply with the rule.

At the first two meetings, the committee extensively reviewed all amendments to the rule and discussed and identified numerous issues related to implementation.

At the third meeting, the committee will review issues related to the rule changes, including if a compliance audit will be required in addition to the Foundation’s annual audit; the reporting requirements; due dates for annual certification; and reducing the Foundation’s overhead by downsizing office space and possibly working remotely.

At the fourth meeting, the committee will make its final decisions and prepare a report for the board of directors.